Certain social posts go viral because they’re so relatable, like this one from a mom in North Carolina:

“My 8-year-old daughter met a girl at summer camp last year named ‘Internet.’ I said no way, that can’t be her name. But my daughter has been adamant. For almost a year, we’ve been having this discussion. ANTOINETTE. I just found out her name is Antoinette.”

While this little misunderstanding led to a hilarious story, the accuracy stakes are often higher — especially regarding your relationships, bank balance, or taxes. And tax laws in the United States are incredibly complicated. In fact, it may surprise you to know:

- The tax code is over 74,000 pages long.

- Over the past ten years, the tax code has been amended more than 4,000 times.

- Even Albert Einstein couldn’t understand taxes. According to his accountant, he once admitted, “The hardest thing in the world to understand is the income tax.”

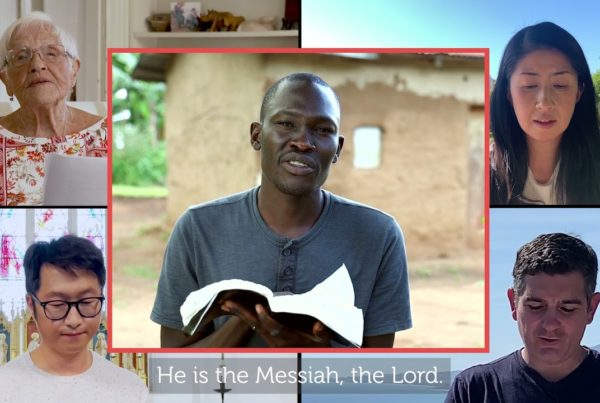

The trick is learning to navigate your financial world wisely. Understanding current tax law can open a new world of generosity for you and compound gifts for the ministries you care about, like Serge. You just need the right tools.

Here are a few tax-wise giving tools to consider:

- Giving from your IRA. You can donate your required minimum distribution if you’re at least 72 years old.

- Gifts of Stock. When you donate appreciated stock, you can avoid Capital Gains, deduct the fair market value, and have a greater impact.

- Donor Advised Funds. When you contribute to your DAF, you are generally eligible for an immediate tax deduction, and your funds grow tax-free.

Other non-cash assets include real estate, private business equity, artwork, collectibles, and cryptocurrency, to name a few. Giving non-cash assets converts the greatest amount of tax into funding. Tax savings are often doubled compared to giving a similar amount of cash.

What non-cash assets has God entrusted to you? How will you steward those gifts? We’re glad to provide free services to help you in your calling.

Smart giving tools make it easy to reduce your tax burden and support the charities you care about.

Not sure which tools are right for you? Reach out to us at partner@serge.org and we’ll help you identify the giving tools that make the most tax sense for you.

Can I Give to Serge From My IRA?

Retirees don’t need to itemize to qualify for this charitable tax break.

Giving through IRAs is becoming increasingly popular.

At the age of 72, required minimum distributions (RMDs) are withdrawn from your IRA. This distribution is considered taxable income. But you can avoid income tax on your RMD by donating this directly to a qualified 501©(3) charity like Serge.

IRA owners must be 70 ½ or older to make a tax-free charitable contribution. If you meet the age requirement, you can transfer up to $100,000 per year directly from an IRA to an eligible charity without paying income tax on the transaction. (If you file jointly, this would be up to $200,000.)

What about 401(k) or similar accounts? Charitable contributions can only be made from IRAs. However, you may be able to roll funds over from a 401(k) to an IRA if you want to make tax-free charitable contributions as part of your retirement plan. It is worth calculating the tax break on this. For a retiree in the 24% tax bracket, an IRA charitable contribution of $5,000 could reduce your income tax bill by $1,200. A $1,000 donation would save you $240.

Remember, you don’t need to itemize your taxes to qualify to make an IRA charitable distribution. But because you are not getting taxed on this money, you cannot additionally claim it as a charitable tax deduction.

In addition, you can donate part of your RMD and withdraw the rest to use as income. Or you can break up the donation to give to multiple charities.

If you are already giving, why not give from your IRA with funds you have to take out anyway?

To get started, fill out this form. We are happy to help with any questions you may have.

For more tax-saving tips OR information on how to include Serge in your will, trust, or estate plan, reach out to us at partner@serge.org.